Nebraska Raffle Laws

These 15 Crazy Laws In Georgia Will Leave You Scratching Your Head In Wonder. We know every state has their own set of crazy laws still in place, so I decided to do some digging and find some of Georgia’s own weird and wacky laws! Having a raffle or contest sounds like a great way to get some publicity for your business with minimal effort. But is it legal? It's true that social media tools make it easier than ever to publicize a contest run by a small business and get lots of people to spread the word about your company. But there are right and wrong ways to go about it.

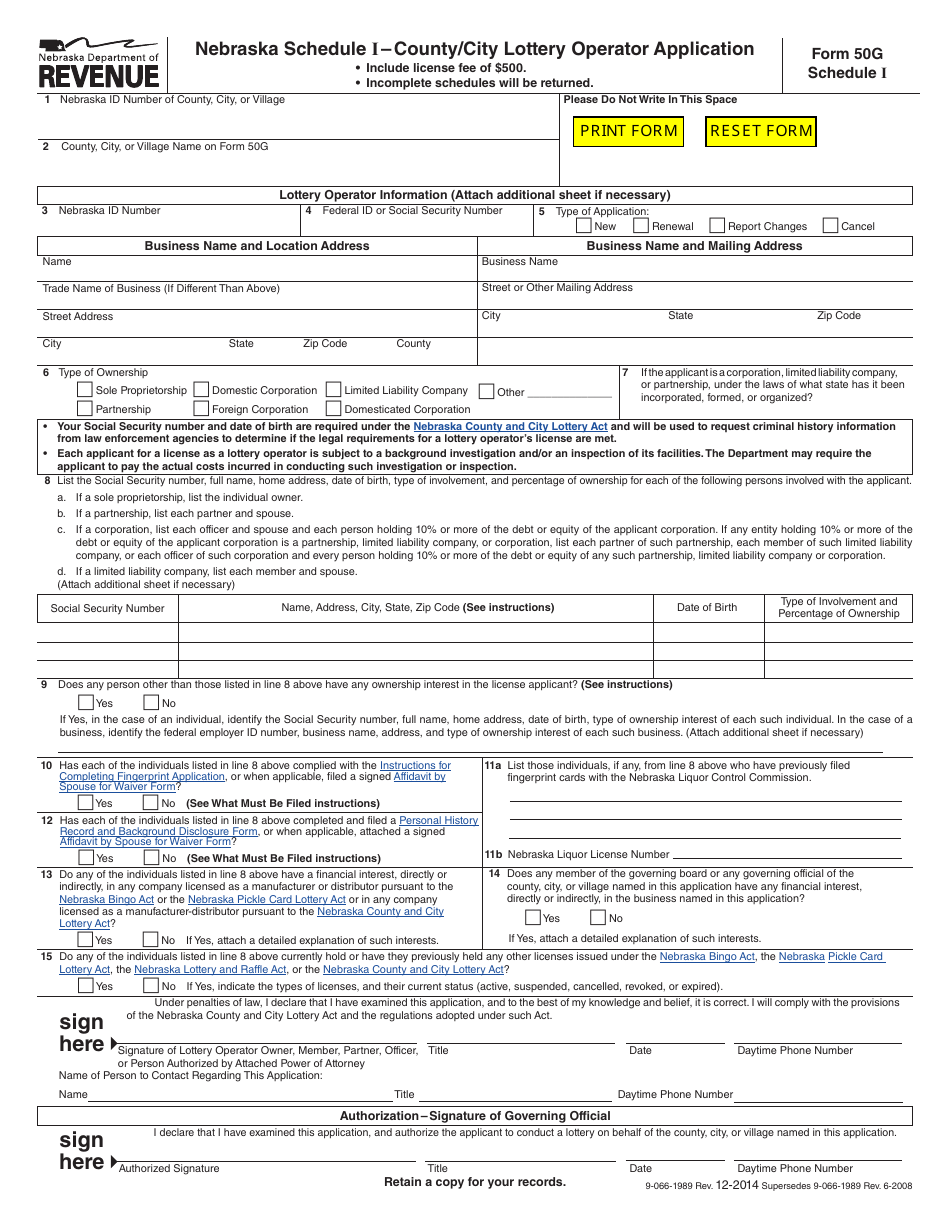

This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. A guidance document does not include internal procedural documents that only affect the internal operations of the DOR and does not impose additional requirements or penalties on regulated parties or include confidential information or rules and regulations made in accordance with the Administrative Procedure Act. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document.

Are Raffles Legal In Nebraska

This guidance document may change with updated information or added examples. DOR recommends you do no print this document. Instead, sign up for the subscription service at revenue.nebraska.gov to get updates on your topics of interest.

Overview

Regulations - Title 316 Nebraska Department of Revenue Regulations on Various Tax Programs. Regulations - Title 350 Property Assessment Regulations Regulations - Title 370 Nebraska Lottery Regulations, If you are looking for other Regulations, please check the Secretary of State's website.

The Nebraska Property Tax Incentive Act (Laws 2020, LB 1107 and Neb. Rev. Stat. §§ 77‑6701 to 77‑6705) provides a refundable income tax credit (credit) or credit against franchise tax imposed on financial institutions for any taxpayer who pays school district property taxes. School district property taxes are property taxes levied by a school district or multiple-district school system on real property, excluding property taxes levied to service bonded indebtedness and property taxes levied as a result of a voter-approved override of the limits on property tax levies. The credit is available for all income tax years beginning on or after January 1, 2020.

The credit is equal to the credit percentage announced by the Nebraska Department of Revenue (DOR) multiplied by the amount of school district property taxes paid during the tax year. For pass-through entities, the school district property taxes paid will be allocated to its owners in the same proportion that income is distributed. The credit percentage for 2020 is 6.0% and is set based on a total amount of credits of $125 million. For future years, the credit percentage will be set based on amounts that may increase if net General Fund revenues increase by more than 3.5%. For the 2024 taxable year, the credit percentage is to be set based on a credit amount of $375 million.

Taxpayers who do not otherwise have a Nebraska income tax filing requirement will need to file a Nebraska Income Tax return to claim the credit. Nebraska residents may claim the credit by filing a Nebraska income tax return for free over the internet using the DOR NebFile system. Visit NebFile for Individuals for eligibility, requirements, and limitations to use this filing system. Nonprofit corporations filing Federal Form 990 or 990-T must file a Nebraska Corporation Income Tax Return, Form 1120N, to claim the credit.

Claiming Credits

The Nebraska Property Tax Incentive Act Credit Computation, Form PTC, must be filed by all taxpayers claiming the credit and by any partnership, S corporation, fiduciary, or limited liability company (LLC) distributing school district property taxes paid to its owners. Form PTC is used to identify parcels and compute the amount of credit that can be claimed on a taxpayer’s Nebraska tax return. Each partnership, S corporation, fiduciary, or LLC must provide its owners or beneficiaries with the information necessary to complete Section C, Form PTC.

DOR encourages taxpayers claiming the credit to use the Nebraska School District Property Tax Look-up Tool (Look-up Tool). The Look-up Tool will assist taxpayers and preparers in determining the allowable dollar amount of school district property taxes paid to the county treasurer for each parcel during the income tax year. Remember, the total amount of tax due reported on your Real Estate Tax Statement is not the amount used to calculate the credit claimed on your Nebraska tax return.

The Form PTC and the Look-up Tool are based upon the following assumptions about the school district property tax paid:

- The school district property tax was paid by the individual or entity that owned the parcel during the property tax year. If you owned a parcel during the tax year, but the property taxes were paid by someone else, you cannot claim the credit for school district property taxes paid on that parcel.

- When a parcel is sold, each owner paid the school district property tax in proportion to the number of ownership days in the property tax year to the total number of days in the property tax year.

- When a parcel is owned by more than one individual or entity, the school district property tax was paid by each owner based on their parcel ownership percentage during the property tax year.

These assumptions may be overcome by providing DOR evidence to the contrary. If any of these assumptions are incorrect, the taxpayer claiming the credit must submit, with their return, documentation supporting the amount of credit claimed.

Nebraska Raffle Laws

Date Paid

The Nebraska school district property tax is considered paid on the date received by the county treasurer where the parcel is located. See below for additional information on the date school district property taxes are paid.

- Parcel sales – The date paid is the date the county treasurer receives payment for the property tax, rather than the closing date of the sale.

- Mortgage escrow accounts – The date paid is the date the county treasurer receives payment, rather than the date the mortgage payment was made.

- County escrow accounts – The date paid is the date the county treasurer applies an amount it held in escrow to the amount of property tax due, rather than the date the escrow payment was made.

Contact Information

Questions regarding the tax credit provided by the Nebraska Property Tax Incentive Act may be directed to:

Tom Milburn

Revenue Tax Specialist, Policy Section

301 Centennial Mall South

PO Box 94818

Lincoln, NE 69509-4818

Phone: 402-471-5814 Fax: 402-471-5946

tom.milburn@nebraska.gov

Jeneé Saffold

Attorney, Policy Section

301 Centennial Mall South

PO Box 94818

Lincoln, NE 69509-4818

Phone: 402-471-5924 Fax: 402-471-5946

jenee.saffold@nebraska.gov